Multiple Choice

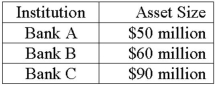

The following three FIs dominate a local market and their total assets are given below.  If Bank C agrees to be purchased by Banks A and B, what proportion of assets of Bank C should be taken by Banks A and B, respectively in order to have equal post-merger assets?

If Bank C agrees to be purchased by Banks A and B, what proportion of assets of Bank C should be taken by Banks A and B, respectively in order to have equal post-merger assets?

A) 52 percent and 48 percent.

B) 50 percent and 40 percent.

C) 56 percent and 44 percent.

D) 40 percent and 50 percent.

E) 45 percent and 55 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The Herfindahl-Hirschman Index (HHI) is a measure

Q31: A Canadian bank subsidiary in the U.S.

Q32: Identify a condition under which conflicts of

Q54: A Eurodollar transaction<br>A)can only occur in Europe.<br>B)is

Q62: The argument that mergers are valuable because

Q70: If the firm commitment price is $15

Q95: Banks increasingly have been susceptible to nonbank

Q108: The use of the Herfindahl-Hirschman Index (HHI)

Q131: In recent years, commercial banks have attempted

Q159: Which of the following describes a firm