Multiple Choice

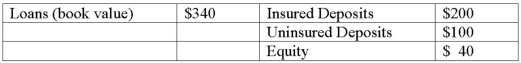

As a result of loan write-offs, Bank A has to be liquidated by the regulators. The book value of the assets and liabilities of the bank is presented below (in millions of dollars) . The market value of the loans has been estimated at $240 million.  What is the current net worth (market value) of the bank?

What is the current net worth (market value) of the bank?

A) +$40 million.

B) $0 million.

C) -$40 million.

D) -$60 million.

E) -$100 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The "too big to fail" policy doctrine

Q12: Which of the following is NOT a

Q13: The contagion effect<br>A)stems from the positive correlation

Q15: Risk-based capital supports risk-based deposit insurance premiums

Q16: The cost of insolvency of an FI

Q34: The prompt corrective action program of the

Q70: The regulatory practice of excessive capital forbearance

Q84: All of the following are associated with

Q86: If regulators provide more protection against bank

Q89: Bank risk taking can be controlled by