Multiple Choice

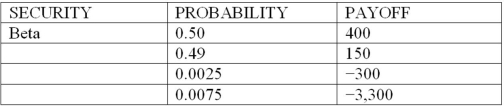

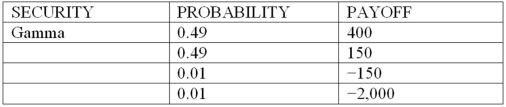

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

What is the one-day, 99% confidence level, value at risk (VAR) of securities Alpha and Beta, respectively (in millions) ?

A) $3 and $25.50

B) $3 and $0.75

C) $248 and 248

D) $300 and $300

E) 300 and 3,300

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The earnings at risk for an FI

Q3: The Volker Rule is intended to reduce

Q4: As securitization of assets continues to expand,

Q7: For situations in which probability distributions exhibit

Q25: A major weakness of the RiskMetrics Model

Q38: In the BIS framework, vertical offsets are

Q40: Income from trading activities of FIs is

Q79: In the BIS standardized framework model, the

Q95: Sumitomo Bank's risk manager has estimated that

Q99: If an FIs trading portfolio of stock