Multiple Choice

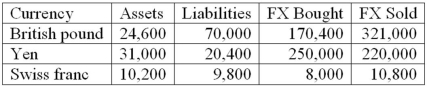

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  What is the FI's net exposure in the Swiss franc?

What is the FI's net exposure in the Swiss franc?

A) +2,400.

B) +400.

C) -2,800.

D) -2,400.

E) +3,200.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Directly matching foreign asset and liability books

Q23: The use of an exchange rate forward

Q31: Off-balance-sheet hedging involves taking a position in

Q32: When purchasing and selling foreign currencies to

Q33: The market in which foreign currency is

Q38: Violation of the interest rate parity theorem

Q52: A positive net exposure position in FX

Q88: An FI has purchased (borrowed) a one-year

Q91: If foreign currency exchange rates are highly

Q105: The total FX risk for a domestic