Multiple Choice

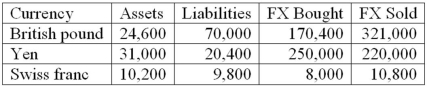

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

A) The FI is net short in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

B) The FI is net short in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

C) The FI is net long in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

D) The FI is net long in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

E) The FI has a balanced position in the Japanese yen.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: An FI has purchased (borrowed) a one-year

Q43: Suppose that the current spot exchange rate

Q45: The following are the net currency positions

Q48: The following are the net currency positions

Q50: The decline in European FX volatility during

Q54: The reason an FI receives a fee

Q72: A positive net exposure position in FX

Q81: FX trading income is derived only from

Q87: Profits in foreign exchange trading have grown

Q106: An FI has purchased (borrowed) a one-year