Multiple Choice

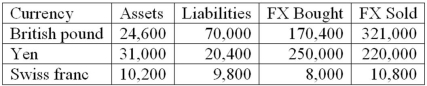

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange rate?

A) The FI is net short in the franc and therefore faces the risk that the franc will rise in value against the U.S. dollar.

B) The FI is net short in the franc and therefore faces the risk that the franc will fall in value against the U.S. dollar.

C) The FI is net long in the franc and therefore faces the risk that the franc will fall in value against the U.S. dollar.

D) The FI is net long in the franc and therefore faces the risk that the franc will rise in value against the U.S. dollar.

E) The FI has a balanced position in the Swiss franc.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The foreign exchange market in Tokyo is

Q17: A positive net exposure position in FX

Q27: The greater the volatility of foreign exchange

Q28: Yen Bank wishes to invest in Yen

Q55: Deviations from the international currency parity relationships

Q66: Your U.S.bank issues a one-year U.S.CD at

Q77: Long-term violations of the interest rate parity

Q86: The underlying cause of foreign exchange volatility

Q94: As of 2012, which of the following

Q102: An FI can eliminate its currency risk