Multiple Choice

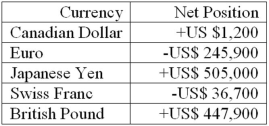

The following are the net currency positions of a U.S. FI (stated in U.S. dollars) . Note: Net currency positions are foreign exchange bought minus foreign exchange sold restated in U.S. dollar terms.  How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

A) The FI is net short in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

B) The FI is net short in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

C) The FI is net long in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

D) The FI is net long in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

E) The FI has a balanced position in the Japanese yen.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Forward contracts in FX are typically written

Q40: An FI has purchased (borrowed) a one-year

Q41: The nominal interest rate is equal to

Q49: Average daily turnover in the FX market

Q50: A negative net exposure position in FX

Q53: An FI has purchased (borrowed) a one-year

Q57: The following are the net currency positions

Q70: According to purchasing power parity (PPP), foreign

Q74: The FI is acting as a hedger

Q75: Most profits or losses on foreign trading