Multiple Choice

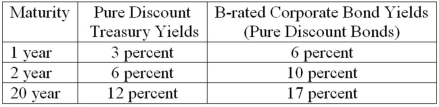

The following represents two yield curves.  What spread is expected between the one-year maturity B-rated bond and the one-year Treasury bond in one year?

What spread is expected between the one-year maturity B-rated bond and the one-year Treasury bond in one year?

A) 3.00 percent.

B) 5.06 percent.

C) 4.00 percent.

D) 5.00 percent.

E) 7.00 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Which of the following is NOT a

Q24: The mortality rate is the past default

Q31: Which of the following is not a

Q50: Because a compensating balance is the proportion

Q66: Usury ceilings are maximum rates imposed by

Q74: The following is information on current spot

Q75: Generally, at the retail level, an FI

Q100: The primary difficulty in arranging a syndicated

Q103: What does the Moody's Analytics model use

Q110: What is the most important factor determining