Multiple Choice

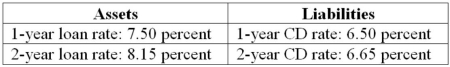

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  If rates do not change, the balance sheet position that maximizes the FI's returns is

If rates do not change, the balance sheet position that maximizes the FI's returns is

A) a positive spread of 15 basis points by selling 1-year CDs to finance 2-year CDs.

B) a positive spread of 100 basis points by selling 1-year CDs to finance 1-year loans.

C) a positive spread of 85 basis points by financing the purchase of a 1-year loan with a 2-year CD.

D) a positive spread of 165 basis points by selling 1-year CDs to finance 2-year loans.

E) a positive spread of 150 basis points by selling 2-year CDs to finance 2-year loans.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Marking-to-market accounting is a market value accounting

Q21: Consider a six-year maturity, $100,000 face value

Q23: For small change in interest rates, market

Q28: First Duration, a securities dealer, has a

Q40: What is the duration of a 5-year

Q62: A bond is scheduled to mature in

Q64: For a given maturity fixed-income asset, duration

Q71: The duration of a consol bond is<br>A)less

Q81: Duration considers the timing of all the

Q96: Duration measures the average life of a