Multiple Choice

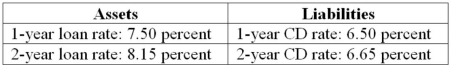

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity, what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity, what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

A) +1.25 years

B) +1.12 years

C) -1.12 years

D) +0.92 years

E) -1.25 years

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Immunization of an FIs net worth requires

Q11: The immunization of a portfolio against interest

Q28: Managers can achieve the results of duration

Q29: In duration analysis, the times at which

Q73: Consider a five-year, 8 percent annual coupon

Q77: An FI has financial assets of $800

Q77: Third Duration Investments has the following assets

Q83: Which of the following is indicated by

Q123: When does "duration" become a less accurate

Q130: The greater is convexity, the more insurance