Multiple Choice

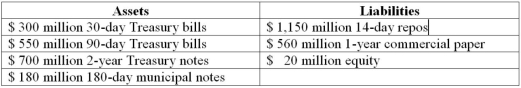

Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year.  What is the leverage-adjusted duration gap?

What is the leverage-adjusted duration gap?

A) 0.605 years.

B) 0.956 years.

C) 0.360 years.

D) 0.436 years.

E) 0.189 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The value for duration describes the percentage

Q10: The following information is about current spot

Q13: Consider a six-year maturity, $100,000 face value

Q25: All fixed-income assets exhibit convexity in their

Q41: Which of the following statements is true?<br>A)The

Q65: Matching the maturities of assets and liabilities

Q73: Convexity is a desirable effect to a

Q93: The cost in terms of both time

Q107: The leverage adjusted duration of a typical

Q115: Buying a fixed-rate asset whose duration is