Multiple Choice

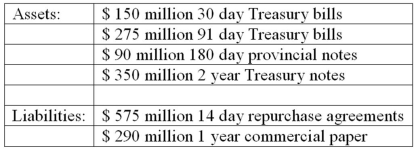

The following are the assets and liabilities of a government security dealer.  Use the repricing model to determine the funding gap for a maturity bucket of 30 days.

Use the repricing model to determine the funding gap for a maturity bucket of 30 days.

A) -$425 million.

B) -$95 million.

C) -$10 million.

D) -$475 million.

E) +$150 million.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: What is spread effect?<br>A)Periodic cash flow of

Q30: If the chosen maturity buckets have a

Q34: The net worth of a bank is

Q37: Which of the following is a weakness

Q38: The balance sheet of ARGH Insurance shows

Q42: A method of measuring the interest rate

Q49: Can an FI immunize itself against interest

Q69: If the interest rate spread between rate

Q74: If interest rates decrease 50 basis points

Q105: If interest rates increase 75 basis points