Multiple Choice

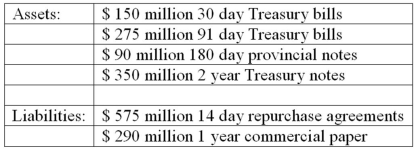

The following are the assets and liabilities of a government security dealer.  Use the repricing model to determine the funding gap for a maturity bucket of 365 days.

Use the repricing model to determine the funding gap for a maturity bucket of 365 days.

A) +$15 million.

B) -$20 million.

C) -$350 million.

D) -$450 million.

E) -$290 million.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: The unbiased expectations theory of the term

Q18: One reason to exclude demand deposits when

Q21: Which theory of term structure argues that

Q23: The following are the assets and liabilities

Q44: When a bank's repricing gap is positive,

Q52: An interest rate increase<br>A)benefits the FI by

Q60: The cumulative repricing gap position of an

Q94: If the average maturity of assets is

Q96: A bank with a negative repricing (or

Q113: If an FI's repricing gap is less