Multiple Choice

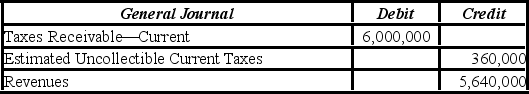

Dover City has calculated that General Fund property tax revenues of $5,640,000 are required for the current fiscal year. Over the past several years, the city has collected 94 percent of all property taxes levied. The city levied property taxes in the amount that will generate the required $5,640,000. Which of the following general journal entries would correctly record the property tax levy?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q78: The city's electric utility fund sent $700,000

Q79: If state law requires that local governments

Q80: In fiscal year 2020 the "Expenditures-2019" account

Q81: Under current GASB standards the revenue from

Q82: Which of the following transactions is classified

Q84: All amounts due to or from other

Q85: The Revenues account of a government is

Q86: The City of Pringle purchased a

Q87: Which of the following types of nonexchange

Q88: Fines and forfeits are reported as charges