Essay

During the current fiscal year, the following transactions (summarized) occurred in the Town of Berthoud Information Technology Internal Service Fund:

1. Employees were paid $290,000 wages in cash.

2. Utility bills received from the Town of Berthoud's Utility Fund during the year amounted to $23,500. The amount had previously been accrued by the Utility Fund.

3. Office expenses paid in cash during the year amounted to $10,500.

4. Service supplies purchased on account during the year totaled $157,500.

5. Parts and supplies used during the year totaled $152,300 (at cost).

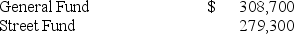

6. Charges to departments during the fiscal year were as follows:

7. Payments to the Utility Fund totaled $21,800.

8. Annual depreciation totaled $30,000 for machinery and equipment.

Prepare the journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Correct Answer:

Verified

Town of Berthoud

Information Technology ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Information Technology ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: GASB standards require that interfund receivables and

Q65: Which of the following items is not

Q66: When a new internal service fund is

Q67: All segments within an enterprise fund are

Q68: In which of the following funds is

Q70: Which of the following is not a

Q71: In the context of regulatory utility plant

Q72: For proprietary funds, governments generally present a

Q73: Equipment acquired under a lease for use

Q74: A statement of cash flows is prepared