Multiple Choice

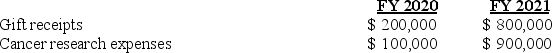

During the years ended June 30, 2020 and 2021, Jackson University, a private university, conducted a cancer research project financed by a $1,000,000 gift from an alumnus. The entire amount was pledged by the donor on July 10, 2019. The gift was restricted to the financing of this particular research project. During the two-year research period, Jackson's gift receipts from the alumnus and research expenses related to the research project were as follows for each fiscal year (FY) :

What amount of net assets was released from restriction in 2020?

A) $200,000.

B) $100,000.

C) $1,000,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A private university following the recommendations of

Q45: Only public colleges and universities are subject

Q46: Earnings on a private college's endowment investments

Q47: Public colleges and universities that use business-type

Q48: Tuition refunds are recorded by debiting Tuition

Q50: Which of the following statements about the

Q51: Private colleges and universities report term endowments

Q52: Which of the following is required as

Q53: Which of the following items would not

Q54: The organizational form of a college can