Multiple Choice

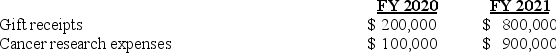

During the years ended June 30, 2020 and 2021, Jackson University, a private university, conducted a cancer research project financed by a $1,000,000 gift from an alumnus. The entire amount was pledged by the donor on July 10, 2019. The gift was restricted to the financing of this particular research project. During the two-year research period, Jackson's gift receipts from the alumnus and research expenses related to the research project were as follows for each fiscal year (FY) :

How much had net assets with donor restrictions increased as of the end of FY 2021?

A) $1,000,000.

B) $100,000.

C) $(100,000) .

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A split-interest agreement is when the university

Q4: Refunds of college or university tuition or

Q5: It would not make economic sense for

Q6: Colleges and universities frequently present outcome measures

Q7: Colleges and universities will report tuition waivers

Q9: The Academy, a private college, provided tuition

Q10: For each of the following definitions, indicate

Q11: GASB accounting and reporting standards applicable to

Q12: Manthei University, a private university, has provided

Q13: Cactus College, a small private college, received