Multiple Choice

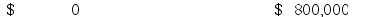

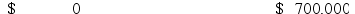

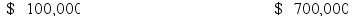

During the year ended June 30, 2020, Hopkins College, a private college, received a federal government grant of $800,000 for research on the role of music in improving math skills for students. Expenses that were not capital in nature for this research amounted to $100,000 during the same year. Under FASB standards, which of the following best represents how Hopkins College would report this nonexchange transaction in the net assets section for the year ended June 30, 2020?

A.

B.

C.

D.

A) Choice A.

B) Choice B

C) Choice C.

D) Choice D.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Both public and private universities report an

Q19: The FASB requires that private colleges and

Q20: "Tuition and fees should be recorded as

Q21: How would estimated uncollectible tuition and fees

Q22: How would a private college or university

Q24: The Uniform Prudent Management of Institutional Funds

Q25: A private college would record a federal

Q26: State educational appropriations received by a public

Q27: Which of the following is not a

Q28: A statement of cash flows is required