Multiple Choice

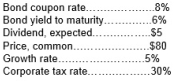

Given an optimal capital structure that is 50% debt and 50% common stock, calculate the weighted average cost of capital for the company given the following additional information:

A) Less than 6%.

B) More than 6% and less than 7%.

C) More than 7% and less than 8%.

D) More than 8%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Although the after-tax cost of debt is

Q16: Although debt financing is generally cheaper than

Q44: A firm's cost of preferred stock is

Q51: Regardless of the particular source of funds

Q69: A firm's cost of financing, in an

Q86: Oak Enterprises has a beta of 1.2,

Q87: Firms in stable industries are advised to

Q88: Most firms are able to use 60%

Q89: A firm's preferred stock pays an annual

Q96: A firm with a higher beta than