Multiple Choice

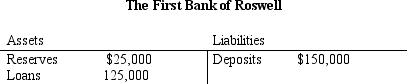

Table 16-4.

-Refer to Table 16-4. If the bank faces a reserve requirement of 10 percent, then the bank

A) is in a position to make a new loan of $15,000.

B) has fewer reserves than are required.

C) has excess reserves of $10,000.

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A double coincidence of wants<br>A)is required when

Q2: Which of the following is an example

Q20: During wars the public tends to hold

Q23: When the Fed conducts open-market purchases,<br>A)banks buy

Q31: The Fed has the power to increase

Q46: Which of the following lists is included

Q57: The money supply increases when the Fed<br>A)lowers

Q138: Federal Reserve governors are given long terms

Q197: The banking system currently has $10 billion

Q203: If a bank that desires to hold