Multiple Choice

Table 16-4.

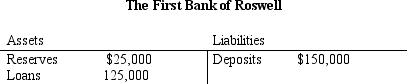

-Refer to Table 16-4. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional $50,000 into his account at the bank. If the bank takes no other action it will

A) have $65,000 in excess reserves.

B) have $55,000 in excess reserves.

C) need to raise an additional $5,000 of reserves to meet the reserve requirement ratio

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: If an economy used gold as money,its

Q43: In a system of 100-percent-reserve banking,<br>A)banks do

Q73: U.S. dollars are an example of commodity

Q79: Marc puts prices on surfboards and skateboards

Q83: If the money multiplier decreased from 20

Q86: The Fed's primary tool to change the

Q92: One surprising thing about the U.S.money stock

Q99: Table 16-4. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4800/.jpg" alt="Table 16-4.

Q102: If the public decides to hold more

Q103: Suppose banks desire to hold no excess