Essay

Currently.the price of consuming housing  is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from

is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from  to

to  .At the same time, the government lowers the tax on other consumption, lowering the price from

.At the same time, the government lowers the tax on other consumption, lowering the price from  to

to  .

.

a.Write down your original budget constraint assuming the consumer has income I.

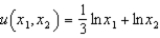

b.Suppose the utility function  captures your tastes, and suppose

captures your tastes, and suppose  ,

,  ,

,  ,

,  and

and  .Write out the utility maximization problem for this consumer prior to any policy change.

.Write out the utility maximization problem for this consumer prior to any policy change.

c.How much housing and other goods will this consumer consume prior to any policy change?

d.When the policy change goes into effect, will this consumer still be able to afford the bundle you derived in (c)?

e.When the policy change goes into effect, what bundle will the consumer consume?

Correct Answer:

Verified

a.  b.

b.  c.

c.  d. Yes, ...

d. Yes, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Currently, the price of consuming housing is

Q3: Suppose that choice sets are convex.State assumptions

Q4: Which of the following statements is correct

Q5: Essential goods give rise to corner solutions.

Q6: Explain how we can estimate the shape

Q8: Suppose tastes satisfy our usual assumptions.Kinks in

Q9: Suppose that choice sets are convex but

Q10: If all goods are essential, a consumer

Q11: If we were the only two people

Q12: In the movie "Baby Boom", Dianne Keaton