Essay

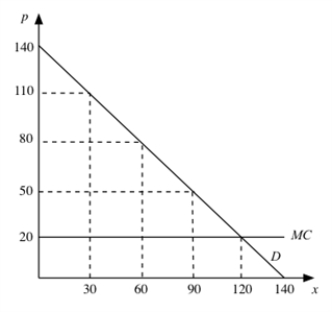

Suppose the market demand curve is as depicted in the graph, and all firms have constant

1

1

24

////AA==

marginal costs of 20.Assume that consumer tastes in x are quasilinear.

a.If a single monopolist who does not price discriminate serves this market, what is the value of consumer surplus and monopoly profit?

b.Suppose the government imposes a price ceiling of 40 on the monopolist from part (a).How does this change the value of consumer surplus and monopoly profit?

c.Suppose instead that this market has two Cournot competitors.Illustrate their best-response functions (labeling intercepts and slopes) as well as the Nash equilibrium.What is the value of consumer surplus and profit in the market now?

d.If the same price ceiling of 40 is imposed on the Cournot oligopoly, how will the best response functions change? (Assume that, if there is a good that is produced but does not get bought, it is equally likely that firm 1 gets stuck with the good as it is that firm 2 gets stuck with it, and it costs at least a penny to dispose of a good you are stuck with.) Is there more than one possible Nash equilibrium?

e.Will overall surplus increase?

f.Does your answer to (e) change if the price ceiling is imposed on Bertrand price competitors?

g.True or False: Whenever price ceilings impact the price at which goods are traded, they disturb the price signal and therefore result in deadweight losses.

Correct Answer:

Verified

a. The monopolist would produce 60 units...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If Bertrand price competitors incur recurring fixed

Q12: Explain why firms in a cartel might

Q13: If two firms in an oligopoly produce

Q14: The more firms there are in an

Q15: Suppose two Bertrand price competitors have different

Q17: In a 2-firm oligopoly, if you can

Q18: Cartels tend not to be long-lived because

Q19: Recurring fixed costs may lead to only

Q20: Firms in a cartel have an incentive

Q21: In the presence of negative pollution externalities,