Essay

Calculate the payback period for each of the following projects, then comment on the advisability of selection based on the payback period criterion in contrast to NPV: Project A has a cost of $15,000, returns $4,000 after-tax the first year and this amount increases by $1,000 annually over the five-year life; Project B costs $15,000 and returns $13,000 after-tax the first year, followed by four years of $2,000 per year.The firm uses a 10 percent discount rate.

B.So payback can seriously underestimate a Project's contribution to business wealth, as illustrated in its contrasting results to that of NPV.

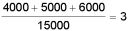

PaybackA:

years

years

PaybackB:

Correct Answer:

Verified

Using payback period alone, project B lo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: The payback rule states that a project

Q57: Evaluate the following project using an IRR

Q58: Ajax Corporation is planning a 10 year

Q60: One method that can be used to

Q65: A Project's payback period is determined to

Q67: A Project's opportunity cost of capital is:<br>A)The

Q78: Calculate the NPV for a project costing

Q81: A new machine will cost $100,000 and

Q84: As the opportunity cost of capital increases,

Q91: Evaluate the following mutually exclusive projects using