Multiple Choice

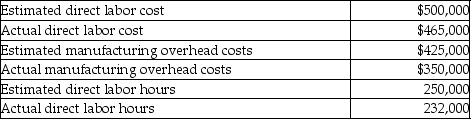

Federer Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Federer Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

If Federer Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

A) $701,509

B) $325,500

C) $395,250

D) $425,000

Correct Answer:

Verified

Correct Answer:

Verified

Q79: The following information was gathered for the

Q81: Krepes Manufacturing has two departments that produce

Q83: In job costing, when indirect materials are

Q86: The following account balances at the beginning

Q87: _ laws , or "take-back" laws, create

Q88: An internal request for raw materials calls

Q89: Which of the following entries would be

Q110: Wet N Wild Sports Equipment Company's work

Q194: When using cost-plus pricing, the markup is

Q311: Generally accepted accounting principles (GAAP)mandate that manufacturing