Multiple Choice

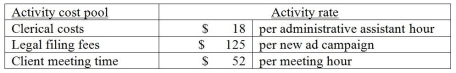

Howard, Fine, & Howard is an advertising agency. The firm uses an activity-based costing system to allocate overhead costs to its services. Information about the firm's activity cost pool rates follows:  Stooge Company was a client of Howard, Fine, & Howard. Recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the Stooge Company account. Using the activity-based costing system, how much overhead cost would be allocated to the Stooge Company account?

Stooge Company was a client of Howard, Fine, & Howard. Recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the Stooge Company account. Using the activity-based costing system, how much overhead cost would be allocated to the Stooge Company account?

A) $917

B) $501

C) $195

D) $3,484

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The cost of fixing defective units found

Q39: Which term listed below describes costs incurred

Q43: Potter & Weasley Company had the following

Q49: Hummingbird Manufacturing manufactures small parts and uses

Q79: Four basic steps are used in an

Q85: If a company were to decrease its

Q118: ABC tends to increase the unit cost

Q121: The cost of product liability claims is

Q225: Lean companies typically cross-train employees to perform

Q259: Which of the following is a result