Multiple Choice

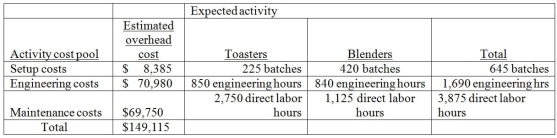

Vandalay Industries manufactures two products: toasters and blenders. The annual production and sales of toasters is 2,200 units, while 1,500 units of blenders are produced and sold. The company has traditionally used direct labor hours to allocate its overhead to products. Toasters require 1.25 direct labor hours per unit, while blenders require 1 direct labor hours per unit. The total estimated overhead for the period is $149,115. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:  The overhead cost per blender using an activity-based costing system would be closest to

The overhead cost per blender using an activity-based costing system would be closest to

A) $ 27.72.

B) $ 73.00.

C) $ 99.41.

D) $ 40.66.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: To determine the amount of overhead allocated,

Q44: Cooper's Bags Company manufactures cloth grocery bags

Q171: Product testing is an appraisal cost.

Q200: Using departmental overhead rates is generally less

Q208: Dursley & Marvolo, Attorneys at Law, provide

Q209: Kramer Company manufactures coffee tables and uses

Q211: Telecom uses activity-based costing to allocate all

Q214: Kramer Company manufactures coffee tables and uses

Q218: The Cosmo Corporation manufactures and assembles office

Q252: When overhead is allocated to every product