Multiple Choice

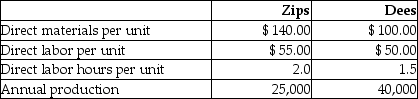

Kepple Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products:  Information about the company's estimated manufacturing overhead for the year follows:

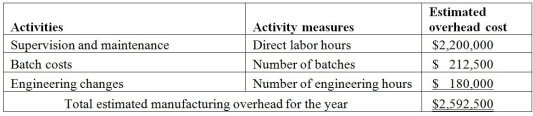

Information about the company's estimated manufacturing overhead for the year follows:  Total estimated direct labor hours for the company for the year are 110,000 hours.

Total estimated direct labor hours for the company for the year are 110,000 hours.

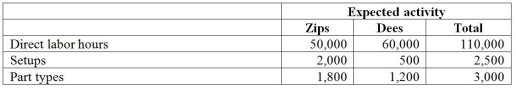

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system. Additional information about production needed for the activity-based costing system follows:  The amount of manufacturing overhead that would be allocated to one unit of Zips using the traditional costing system would be closest to

The amount of manufacturing overhead that would be allocated to one unit of Zips using the traditional costing system would be closest to

A) $35.35.

B) $23.57.

C) $47.14.

D) $32.86.

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Two main benefits of ABC are (1)more

Q81: Which of the following is a sign

Q93: The cost of training quality control supervisors

Q150: Facility-level activities and costs are incurred for

Q156: On a cost of quality report, which

Q159: Kramer Company manufactures coffee tables and uses

Q161: James Industries uses departmental overhead rates to

Q163: Beartowne Enterprises uses an activity-based costing system

Q176: Which of the following is not likely

Q229: Value-engineering is accomplished by eliminating,reducing,or simplifying all