Multiple Choice

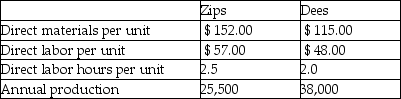

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products:  Information about the company's estimated manufacturing overhead for the year follows:

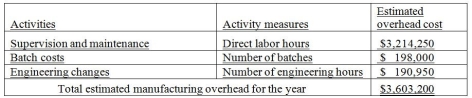

Information about the company's estimated manufacturing overhead for the year follows:  Total estimated direct labor hours for the company for the year are 110,000 hours.

Total estimated direct labor hours for the company for the year are 110,000 hours.

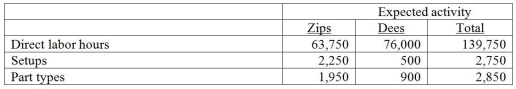

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system. Additional information about production needed for the activity-based costing system follows:  The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to

The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to

A) $94.82.

B) $64.46.

C) $48.53.

D) $13.20.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The cost of inspection at various stages

Q88: Beartowne Enterprises uses an activity-based costing system

Q89: Salvatore LLC provides a wide variety of

Q91: Potter & Weasley Company had the following

Q94: Bilingsly Limited, a manufacturer of a variety

Q116: The cost of testing incoming raw materials

Q129: What will the use of departmental overhead

Q140: Non-value added activities are activities that neither

Q239: Cooper's Bags Company manufactures cloth grocery bags

Q257: Non-value added activities are<br>A)also called waste activities.<br>B)activities