Essay

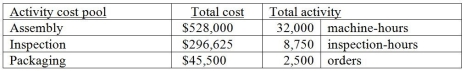

Burning River Corporation, a manufacturer of a variety of products, uses an activity-based costing system. Information from its system for the year for all products follows:  Burning River Corporation makes 750 of its product X14 a year, which requires a total of 55 machine hours, 20 inspection hours, and 18 orders. Product X14 requires $77.00 in direct materials per unit and $65.00 in direct labor per unit. Product X14 sells for $195 per unit.

Burning River Corporation makes 750 of its product X14 a year, which requires a total of 55 machine hours, 20 inspection hours, and 18 orders. Product X14 requires $77.00 in direct materials per unit and $65.00 in direct labor per unit. Product X14 sells for $195 per unit.

Required:

a. Calculate the cost pool activity rate for each of the three activities.

b. How much manufacturing overhead would be allocated to Product X14 in total?

c. What is the product margin in total for Product X14?

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Research and development would most likely be

Q47: The benefits of adopting ABC/ABM are higher

Q58: If a company's plantwide overhead rate is

Q66: Costs incurred to detect poor quality goods

Q86: High Rise Display Company manufactures display cases

Q96: Companies often refine their cost allocation systems

Q101: Back Porch Company manufactures lawn chairs using

Q104: Darlington & Myrtle, Attorneys at Law, provide

Q131: Product-level activities and costs are incurred for

Q240: A plantwide overhead rate is calculated by