Multiple Choice

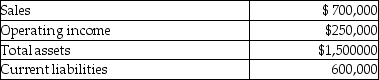

The Sunny Division of Miami Corporation reported the following results from the past year. Shareholders require a return of 10%. Management calculated a weighted-average cost of capital (WACC) of 5%. Sunny's corporate tax rate is 30%.  What is the division's Residual Income (RI) ?

What is the division's Residual Income (RI) ?

A) $70,000

B) $77,500

C) $100,000

D) $250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Davis Corporation manufactures and sells portable radios.The

Q26: Southern Instruments makes calculators for business applications.The

Q26: Financial performance measures are known as lag

Q54: The duties of an investment center manager

Q123: Flexible budgets are budgets that summarize cost

Q134: Ringo Corporation had the following results last

Q135: The Crest division of Procter & Gamble

Q136: The success of a(n)_ is measured not

Q142: Employee satisfaction would be an example of

Q143: The number of new products developed would