Essay

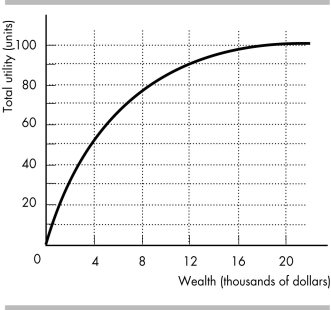

-Larry owns a car worth $20,000, and that is his only wealth. There is a 10 percent chance that Larry will have an accident within a year. If he does have an accident, his car is worthless. Larry's utility of wealth curve is shown in the figure above. An insurance company agrees to pay a car owner like Larry the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,500 per policy.

a) What is Larry's expected wealth?

b) What is Larry's expected utility?

c) What is the maximum amount that Larry is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Larry buy the insurance policy? Why or why not?

Correct Answer:

Verified

a) The probability that Larry will have ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q208: A risk averse person has diminishing marginal

Q209: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -James has a

Q210: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Ashton has the

Q211: Mike owns a car worth $20,000, and

Q212: The cost of risk is the amount

Q214: Adriana wants to try working as an

Q215: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Beachcomber Beatrice spent

Q216: Suppose Nara could invest her $1000 in

Q217: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Wendy works as

Q218: Suppose Nara could invest her $1000 in