Essay

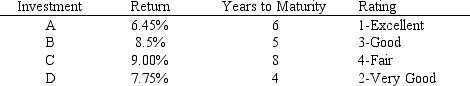

A financial planner wants to design a portfolio of investments for a client. The client has $400,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 30% of the money in any one investment, at least one half should be invested in long-term bonds which mature in six or more years, and no more than 40% of the total money should be invested in B or C since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

Formulate the LP for this problem.

Formulate the LP for this problem.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Robert Hope received a welcome surprise in

Q9: A company needs to purchase several new

Q10: What action is required to make Risk

Q11: A hospital needs to determine how many

Q12: <br>The following questions are based

Q14: <br>The following questions are based

Q15: Which tab in the Risk Solver Platform

Q16: A farmer is planning his spring planting.

Q17: Spreadsheet modeling is an acquired skill because<br>A)there

Q59: How many constraints are there in a