Multiple Choice

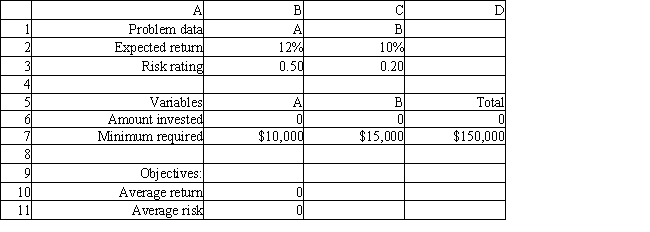

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. What formula goes in cell B11?

A) =SUMPRODUCT(B2:C2,$B$6:$C$6) /$D$7

B) =B2*C2+B3*C3

C) =SUMPRODUCT(B3:C3,$B$6:$C$6) /$D$7

D) =SUMPRODUCT(B3:C3,$B$6:$C$6)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A dietitian wants to formulate a low

Q5: A company wants to purchase large and

Q6: An investor wants to invest $50,000 in

Q7: Exhibit 7.1<br>The following questions are based on

Q8: Exhibit 7.1<br>The following questions are based on

Q10: Deviational variables<br>A) are added to constraints to

Q11: Goal programming solution feedback indicates that the

Q12: The "triple bottom line" incorporates multiple objective

Q13: What is the soft constraint form of

Q14: If no other feasible solution to a