Essay

An investor is developing a portfolio of stocks. She has identified 3 stocks in which to invest. She wants to earn at least 11% return but with minimum risk.

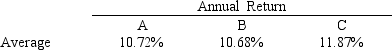

The average return for the stocks is:

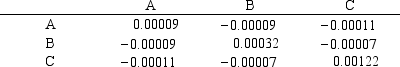

The covariance matrix for the stocks is:

The covariance matrix for the stocks is:

Let: Pi = proportion of total funds invested in i, i = A, B, C

Let: Pi = proportion of total funds invested in i, i = A, B, C

Formulate the NLP for this problem.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: How much are additional units of Labor

Q8: The optimal solution to a LP problem

Q9: An investor is developing a portfolio

Q10: How many local maximum solutions are there

Q13: An investor wants to determine how much

Q14: A company wants to locate a new

Q15: A company wants to locate a new

Q16: How much must the objective function coefficient

Q44: The optimal trade-off between risk and return

Q78: The Lagrange Multiplier is similar to which