Essay

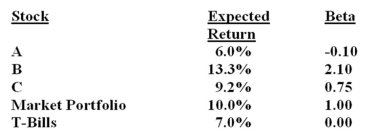

An investor is considering the three stocks given below:

Calculate the expected return and beta of a portfolio equally weighted between stocks B and C. Demonstrate that holding stock A actually reduces risk by comparing the risk of a portfolio equally weighted between stock B and T-Bills with a portfolio equally weighted between stocks B and A.

Calculate the expected return and beta of a portfolio equally weighted between stocks B and C. Demonstrate that holding stock A actually reduces risk by comparing the risk of a portfolio equally weighted between stock B and T-Bills with a portfolio equally weighted between stocks B and A.

Correct Answer:

Verified

Stock B and C: Rp = .5(13.3%) +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: The systematic response coefficient for productivity,β<sub>p</sub>,would produce

Q32: Which of the following statements is true?<br>A)

Q33: A factor is a variable that:<br>A) affects

Q34: Parametric or empirical models rely on:<br>A) security

Q35: You have a 3 factor model to

Q37: An advantage of the APT over CAPM

Q38: Assume that the single factor APT model

Q39: A growth stock portfolio and a value

Q40: Assuming that the single factor APT model

Q41: The Fama-French three factor model includes the