Multiple Choice

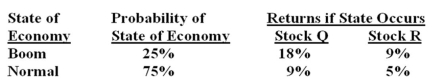

What is the standard deviation of a portfolio that is invested 40% in stock Q and 60% in stock R?

A) 0.7%

B) 1.4%

C) 2.6%

D) 6.8%

E) 8.1%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q29: Risk that affects at most a small

Q67: The beta of a security is calculated

Q68: The variance of Stock A is .004,the

Q69: The risk premium for an individual security

Q70: If the covariance of stock 1 with

Q71: The Capital Market Line is the pricing

Q74: When a security is added to a

Q77: The dominant portfolio with the lowest possible

Q79: The market risk premium is computed by:<br>A)

Q91: The primary purpose of portfolio diversification is