Multiple Choice

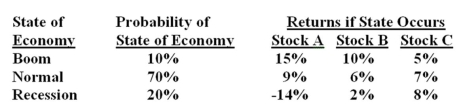

What is the standard deviation of a portfolio which is invested 20% in stock A,30% in stock B and 50% in stock C?

A) 0.6%

B) 0.9%

C) 1.8%

D) 2.2%

E) 4.9%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q45: The amount of systematic risk present in

Q57: The percentage of a portfolio's total value

Q58: If the economy booms,RTF,Inc. stock is expected

Q59: What is the variance of a portfolio

Q61: Your portfolio has a beta of 1.18.

Q63: The variance of Stock A is .005,the

Q64: The expected return on HiLo stock is

Q65: The separation principle states that an investor

Q67: The beta of a security is calculated

Q96: Unsystematic risk:<br>A)can be effectively eliminated through portfolio