Multiple Choice

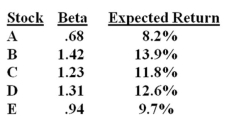

Which one of the following stocks is correctly priced if the risk-free rate of return is 2.5% and the market risk premium is 8%?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: The market has an expected rate of

Q31: You have plotted the data for two

Q32: If investors possess homogeneous expectations over all

Q33: If the correlation between two stocks is

Q34: Quantpiks has been a hot stock the

Q36: In the first chapter,it was stated that

Q37: Zelo,Inc. stock has a beta of 1.23.

Q39: You would like to combine a risky

Q40: For a highly diversified equally weighted portfolio

Q89: Risk that affects a large number of