Multiple Choice

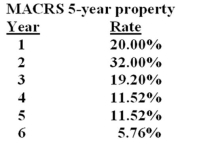

Winslow,Inc. is considering the purchase of a $225,000 piece of equipment. The equipment is classified as 5-year MACRS property. The company expects to sell the equipment after four years at a price of $50,000. What is the after-tax cash flow from this sale if the tax rate is 35%?

A) $37,036

B) $38,880

C) $46,108

D) $47,770

E) $53,892

Correct Answer:

Verified

Correct Answer:

Verified

Q86: Should financing costs be included as an

Q90: Kay's Nautique is considering a project which

Q91: Foamsoft sells customized boat shoes. Currently,it sells

Q92: You own a house that you rent

Q93: Big Joe's owns a manufacturing facility that

Q94: Margarite's Enterprises is considering a new project.

Q97: The depreciation method currently allowed under U.S.

Q98: Ben's Border Café is considering a project

Q99: The cash flows of a project should:<br>A)

Q100: Bet'r Bilt Toys just purchased some MACRS