Multiple Choice

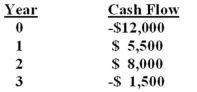

You are considering an investment with the following cash flows. If the required rate of return for this investment is 13.5%,should you accept it based solely on the internal rate of return rule? Why or why not?

A) Yes; because the IRR exceeds the required return.

B) Yes; because the IRR is a positive rate of return.

C) No; because the IRR is less than the required return.

D) No; because the IRR is a negative rate of return.

E) You can not apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: An investment cost $12,000 with expected cash

Q23: You are analyzing two mutually exclusive projects

Q24: What is the net present value of

Q25: A mutually exclusive project is a project

Q26: Analysis using the profitability index:<br>A) frequently conflicts

Q28: An investment with an initial cost of

Q30: When two projects both require the total

Q31: The internal rate of return is:<br>A) more

Q32: The payback period rule accepts all investment

Q83: The discount rate that makes the net