Multiple Choice

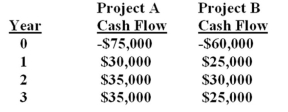

The Camel Company is considering two mutually exclusive projects with the following cash flows. The incremental IRR is _______ and if the required rate is higher than the crossover rate then project _______ should be accepted.

A) 13.94%; A

B) 13.94%; B

C) 15.44%; A

D) 15.44%; B

E) 15.86%; A

Correct Answer:

Verified

Correct Answer:

Verified

Q92: The Liberty Co. is considering two projects.

Q93: An investment cost $10,000 with expected cash

Q94: The Ziggy Trim and Cut Company can

Q95: Accepting positive NPV projects benefits the stockholders

Q96: A project has an initial cost of

Q98: An investment with an initial cost of

Q99: What is the net present value of

Q100: Consider an investment with an initial cost

Q101: You would like to invest in the

Q102: The two fatal flaws of the internal