Multiple Choice

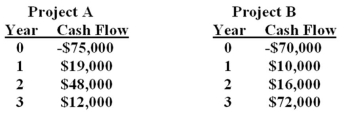

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the internal rate of return (IRR) and the information provided in the problem,you should:

A) accept both project A and project B.

B) reject both project A and project B.

C) accept project A and reject project B.

D) accept project B and reject project A.

E) ignore the IRR rule and use another method of analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Based on the profitability index (PI) rule,should

Q9: The discounted payback rule states that you

Q10: The primary reason that company projects with

Q11: Homer is considering a project which will

Q12: The possibility that more than one discount

Q14: The Ziggy Trim and Cut Company can

Q15: The profitability index is the ratio of:<br>A)

Q16: The internal rate of return (IRR): I.

Q17: A project has an initial cost of

Q18: Which one of the following is the