Multiple Choice

Your corporation has the following cash flows:

Operating income:$250,000

Interest received:10,000

Interest paid:45,000

Dividends received:20,000

Dividends paid:50,000

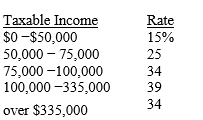

If 70 percent of dividends received are excludable,and if the applicable tax table is as follows, What is the corporation's tax liability?

What is the corporation's tax liability?

A) $57,530

B) $65,350

C) $69,440

D) $88,350

E) $100,280

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Which of the following does not need

Q46: Managers can increase the value of a

Q47: The fact that a proprietorship,as a business,pays

Q48: Which of the following is not a

Q49: The major advantage of a regular partnership

Q51: A financial decision which results in an

Q52: By maximizing the earnings of the firm

Q53: Which of the following statements is correct?<br>A)

Q54: _ decisions are decisions about how much

Q55: Multinational managerial finance requires that financial analyses