Multiple Choice

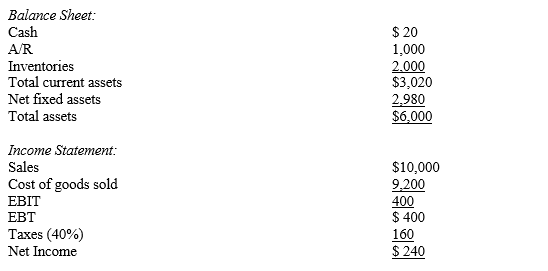

Collins Company had the following partial balance sheet and complete income statement information for 2010:  The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

A) 33.33%

B) 45.28%

C) 52.75%

D) 60.00%

E) 65.71%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The income statement measures the flow of

Q11: The inventory turnover ratio and days sales

Q11: The time dimension is important in financial

Q12: Pepsi Corporation's current ratio is 0.5, while

Q65: You are given the following information: Stockholders'

Q67: The accrual method of accounting recognizes revenue

Q68: Suppose a firm wants to maintain a

Q70: If a firm borrows money from a

Q75: A firm has a debt ratio of

Q76: We can use the fixed asset turnover