Multiple Choice

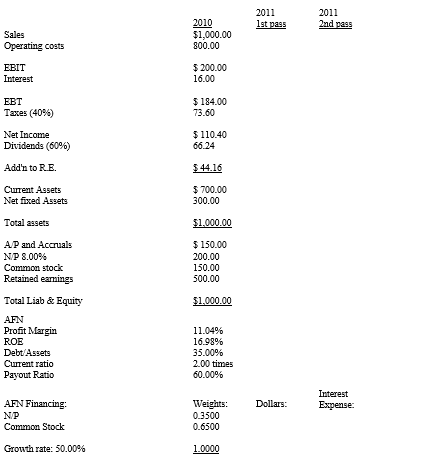

You have been given the information below on the Crum Company.Crum expects sales to grow by 50% in 2011,and operating costs should increase at the same rate.Fixed assets were being operated at 40% of capacity in 2010,but all other assets were used to full capacity.Underutilized fixed assets cannot be sold.Current assets and spontaneous liabilities should increase at the same rate as sales during 2011.The company plans to finance any external funds needed as 35% notes payable and 65% common stock.After taking financing feedbacks into account,and after the second pass,what is Crum's projected ROE using the projected balance sheet method?

Information on the Crum Company:

A) 16.98%

B) 23.73%

C) 25.68%

D) 19.61%

E) 23.24%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A typical sales forecast,though concerned with future

Q23: Compuvac Company has just completed its first

Q24: Other things held constant,a high degree of

Q25: What is the next step in the

Q26: Hogan Inc.generated EBIT of $240,000 this past

Q28: The degree of financial leverage gives an

Q29: Two key objectives of financial planning and

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2180/.jpg" alt=" -Refer to Trident

Q31: The use of a high level of

Q32: Today,computer simulations models can calculate multiple breakeven