Multiple Choice

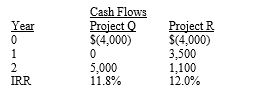

Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics:  If the firm's required rate of return (r) is 10 percent,which project should be purchased?

If the firm's required rate of return (r) is 10 percent,which project should be purchased?

A) Both projects should be purchased,because the IRRs for both projects exceed the firm's required rate of return.

B) Neither project should be accepted,because the IRRs for both projects exceed the firm's required rate of return.

C) Project Q should be accepted,because its net present value (NPV) is higher than Project R's NPV.

D) Project R should be accepted,because its net present value (NPV) is higher than Project Q's NPV.

E) None of the above is a correct answer.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Perpetuities represent a series of even cash

Q48: Find the present value of an income

Q49: Which of the following statements is most

Q50: The NPV method implicitly assumes that the

Q51: NPV and IRR will always lead to

Q53: Your client just turned 75 years old

Q54: In its first year of operations,2001,the Gourmet

Q55: The advantage of the payback period over

Q56: Cash flow time lines are used primarily

Q57: On January 1,2006,a graduate student developed a