Multiple Choice

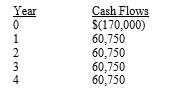

Union Atlantic Corporation,which has a required rate of return equal to 14 percent,is evaluating a capital budgeting project that has the following characteristics:  Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information,which of the following statements is correct?

Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information,which of the following statements is correct?

A) The project's internal rate of return (IRR) must be greater than 14 percent.

B) The project's discounted payback must be less that its economic life.

C) The project should be purchased by Union Atlantic.

D) All of these statements are correct.

E) None of these statements is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: If $100 is placed in an account

Q20: Financial calculator and tabular methods use different

Q21: What is the present value of a

Q22: Gomez Electronics needs to arrange financing for

Q23: You can deposit your savings at the

Q25: We can think of inflation occurring over

Q26: You just graduated,and you plan to work

Q27: As the winning contestant in a television

Q28: Assume that you just had a child,and

Q29: Assume that you are graduating,that you plan