Multiple Choice

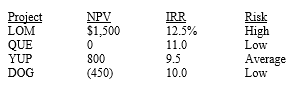

A college intern working at Anderson Paints evaluated potential investments⎯that is,capital budgeting projects⎯using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

A) Project LOM only,because it has both the highest NPV and the higher IRR.

B) Projects LOM,QUE,and YUP,because they all have positive NPVs and their IRRs.

C) Projects DOG and QUE,because their IRRs are greater than their risk-adjusted discount he projects returns are higher than the rates of return that capital budgeting manager uses to evaluate them.

D) Projects QUE,YUP,and DOG,because their IRRs are greater than their risk-adjusted discount rates-that is,the projects returns are higher than the rates of return that capital budgeting manager uses to evaluate them.

E) There is not enough information to answer this question,because the firm's average required rate of return cannot be determined.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The future value of a cash flow

Q2: Your employer has agreed to make 80

Q3: The post-audit two main purposes are to

Q5: Suppose you put $100 into a savings

Q6: There exists an IRR solution for each

Q7: Steaks Galore needs to arrange financing for

Q8: The opportunity cost rate is only applicable

Q9: The present value of a future cash

Q10: Supposed someone offered you the choice of

Q11: Drexel Corporation has been enjoying a phenomenal