Multiple Choice

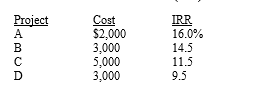

Anderson Company has four investment opportunities with the following costs (all costs are paid at t = 0) and estimated internal rates of return (IRR) :  The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,

The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,  = $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

= $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

A) 7.75%

B) 8.90%

C) 10.46%

D) 11.54%

E) 12.68%

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Which of the following statements is correct?<br>A)

Q31: A firm must earn the marginal cost

Q32: Gargoyle Unlimited<br>Gargoyle Unlimited is planning to issue

Q33: Even if a firm obtains all of

Q36: Capital refers to items on the right-hand

Q37: In applying the CAPM to estimate the

Q38: Becker Glass Corporation<br>Becker Glass Corporation expects to

Q39: Company can't lower its total cost of

Q40: The cost of debt is equal to

Q40: Gargoyle Unlimited<br>Gargoyle Unlimited is planning to issue